Smart Money Forex Trading

Forex trading is one of the largest and most liquid financial markets in the world, but success in trading isn’t just about luck, it’s about understanding how institutional players operate. Smart money refers to big financial institutions, hedge funds, and central banks that drive the market. These entities use sophisticated strategies to manipulate price movements and create trading opportunities that retail traders can capitalize on. This guide explores how Smart Money Forex Trading operates and how you can align your trading strategies with institutional flow for financial success.

What is Smart Money in Forex Trading?

Smart Money Forex Trading represents the trading activity of major financial institutions that have the capital, technology, and experience to influence the forex market. These players move billions in currency, using advanced algorithms and insider knowledge to exploit market inefficiencies.

How Smart Money Operates:

- Liquidity Hunts: Institutions trigger stop-losses of retail traders to accumulate liquidity before major price movements.

- Order Blocks: Banks and hedge funds place large orders at key price levels to control market direction.

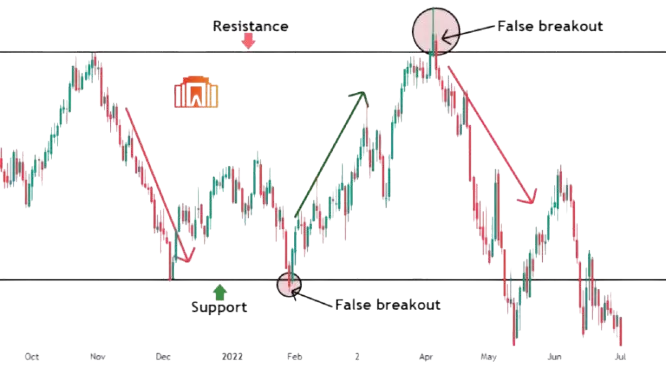

- Market Manipulation: Institutions often create false breakouts or fake reversals to mislead retail traders.

Identifying Smart Money Moves in Forex Trading

To successfully trade with Smart Money Forex Trading, you must learn to recognize key institutional footprints. Here are some ways to do that:

1. Institutional Order Flow Analysis

- Look for aggressive buying or selling patterns in high-volume areas.

- Analyze candlestick wicks near support and resistance—long wicks indicate liquidity grabs.

- Use order flow indicators, such as the Volume Profile, to track where institutions are accumulating positions.

2. Smart Money Indicators

Several indicators help identify institutional trading activity:

i. Volume Profile: Shows where institutional orders are placed.

ii. Wyckoff Theory: Tracks accumulation and distribution phases of smart money.

iii. Fair Value Gaps (FVG): Identifies price inefficiencies that institutions exploit.

3. Trading with Supply & Demand Zones

Smart Money Forex Trading respects supply and demand zones more than traditional support/resistance lines. Here’s how to spot them:

i. Supply Zone: Price sharply declines from this level due to institutional selling.

ii. Demand Zone: Price bounces due to institutional buying pressure.

Smart Money Trading Strategies for Forex Traders

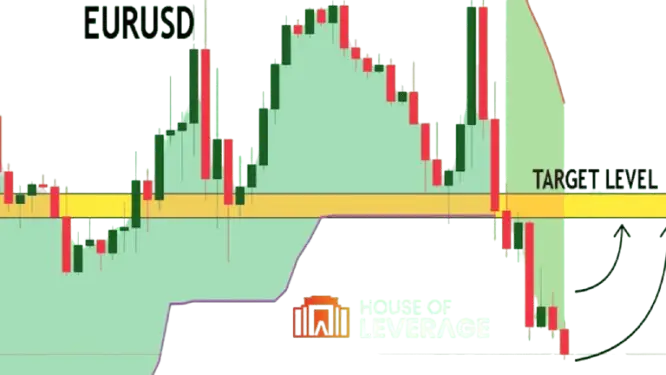

1. The Liquidity Grab Strategy

How it Works:

- Institutions push price below a key support level to trigger stop-losses of retail traders.

- After stop-losses are hit, price reverses sharply in the original direction.

- Traders can enter after confirmation of a bullish/bearish rejection.

Example: If the EUR/USD pair breaks below a support level, but wicks back up with strong buying volume, it could be a liquidity grab signaling a potential buy opportunity.

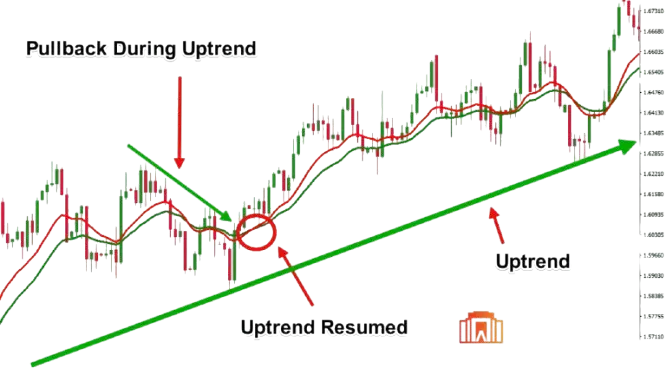

2. Institutional Trend Trading

Institutions rarely trade against the trend. You can follow their lead by:

- Identifying strong higher highs and higher lows (bullish trend).

- Using moving averages (e.g., 50 EMA & 200 EMA) to confirm smart money alignment.

- Entering trades after pullbacks to institutional support zones.

Example: If GBP/USD is in an uptrend and pulls back to the 50 EMA, institutions might enter at that level, making it an ideal buy zone.

3. Stop Hunt & Reversal Strategy

- Smart money pushes price below a key level to trigger retail traders’ stop-losses.

- Price reverses sharply once liquidity is collected.

- Traders enter after a confirmation candle or divergence on RSI/MACD.

Example: A false breakout of USD/JPY below key support followed by a bullish engulfing candle signals a reversal opportunity.

Psychology of Smart Money Forex Trading

One of the biggest mistakes retail traders make is reacting emotionally to market movements. Smart Money Forex Trading takes advantage of this by creating panic or euphoria to trap traders. How to Develop a Smart Money Mindset:

i. Stay Patient: Institutions wait for the perfect price levels—so should you.

ii. Avoid Impulsive Trades: Never chase price movements; wait for confirmations.

iii. Think Like an Institution: If a trade looks “too obvious,” it might be a trap.

Risk Management for Smart Money Traders

Even the best traders experience losses. Here’s how you can minimize risk:

1% Rule: Never risk more than 1% of your trading account per trade.

Use Stop Losses Wisely: Set SL below institutional demand zones, not random levels.

Risk-Reward Ratio: Aim for at least 1:2 or 1:3 (Risk $100 to make $200+).

Diversify Currency Pairs: Don’t focus on a single currency watch multiple markets.

Common Myths About Smart Money Trading

❌ Myth 1: Smart Money Always Wins

Even institutions take losses; they just manage them better.

❌ Myth 2: Retail Traders Can’t Beat Institutions

Retail traders can profit by following institutional footprints instead of fighting them.

❌ Myth 3: Indicators Alone Can Predict Smart Money Moves

Indicators help, but understanding market structure and price action is more important.

Conclusion: Mastering Smart Money Trading

Understanding how institutions manipulate the Smart Money Forex Trading gives traders an edge. By analyzing order flow, identifying liquidity grabs, and using institutional trading strategies, you can improve your trading performance.

Key Takeaways:

Follow institutional order flow and volume.

Trade with supply & demand zones, not random support/resistance.

Use risk management to protect your capital.

Disclaimer: Forex trading involves significant risk, and past performance does not guarantee future results. This article Smart Money Forex Trading, is for educational purposes only and should not be considered financial advice.

Further Reading & Resources

Recommended Books:

- “The Art & Science of Technical Analysis” – Adam Grimes

- “Trading in the Zone” – Mark Douglas

🔗 Helpful Tools:

- Forex Factory (Economic Calendar) – www.forexfactory.com

- TradingView (Advanced Charting) – www.tradingview.com

By implementing Smart Money Forex Trading concepts and refining your strategy, you can elevate your forex trading game and move closer to financial independence.