In the ever-evolving world of financial markets, success often hinges on mastering trading strategies that adapt to changing conditions. Whether you’re a seasoned professional or just starting your trading journey, having a reliable arsenal of techniques is essential for navigating the complexities of the market. At House of Leverage, a trusted global proprietary trading firm funding traders worldwide, we understand what it takes to thrive in this dynamic environment.

Top 10 trading strategies you should master in 2025

1. Trend Following

Trend following remains one of the most popular strategies for traders across markets. The idea is simple: “The trend is your friend.” This approach involves identifying and riding the market’s direction until the trend shows signs of reversal.

- How to implement: To confirm trends, use moving averages, trendlines, and indicators like the Average Directional Index (ADX).

- Best for: Forex traders, stock market enthusiasts, and day traders.

- Tip: Combine trend following with risk management tools to avoid significant losses when trends reverse.

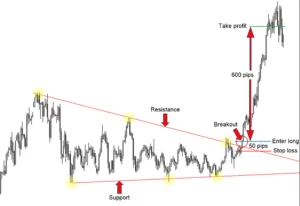

2. Breakout Trading

Breakout trading focuses on identifying key support and resistance levels. When the price breaks through these levels, it often signals the start of a new trend.

- How to implement: Look for breakouts using chart patterns like triangles, flags, and rectangles.

- Best for: Cryptocurrency traders and swing traders.

- Tip: Volume confirmation is crucial. Ensure breakouts are accompanied by high trading volumes for reliability.

3. Scalping

Scalping is a high-frequency under trading strategies for profiting from small price movements. It requires precision, quick decision-making, and advanced tools.

- How to implement: Use one-minute or five-minute charts to identify quick opportunities in highly liquid markets.

- Best for: Forex traders and day traders.

- Tip: Ensure low transaction costs, as frequent trades can eat into profits.

4. Reversal Trading

This strategy involves anticipating when a trend will reverse and entering trades accordingly. It’s a high-risk, high-reward approach that requires careful analysis.

- How to implement: Use tools like the Relative Strength Index (RSI) or candlestick patterns (e.g., hammer or shooting star) to spot potential reversals.

- Best for: Experienced traders and financial professionals.

- Tip: Always confirm reversal signals with multiple indicators to reduce false positives.

5. Momentum Trading

Momentum trading focuses on stocks or assets moving significantly in one direction with high volume. Traders aim to capitalize on the velocity of price changes.

- How to implement: Identify momentum using indicators like the Moving Average Convergence Divergence (MACD) or RSI.

- Best for: Stock market enthusiasts and cryptocurrency traders.

- Tip: Exit positions early to lock in profits before momentum fades.

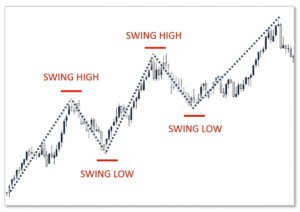

6. Swing Trading

Swing trading aims to capture short- to medium-term gains within an established trend. Positions are typically held for several days to weeks.

- How to implement: Use Fibonacci retracements, Bollinger Bands, or price oscillators to pinpoint entry and exit points.

- Best for Beginners and swing traders.

- Tip: Swing trading works best in stable markets with clear price cycles.

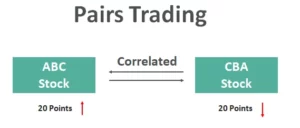

7. Pairs Trading

Pairs trading is a market-neutral strategy involving buying one asset while shorting another correlated asset. The goal is to profit from the relative price movement between the two.

- How to implement: Look for pairs with strong historical correlations and divergence in price.

- Best for: Financial professionals and advanced traders.

- Tip: Conduct a thorough statistical analysis to ensure a valid correlation before trading.

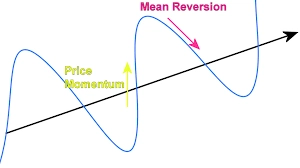

8. Mean Reversion

Mean reversion assumes that prices return to their historical averages over time. This strategy works well in range-bound markets.

- How to implement: Identify overbought or oversold conditions using Bollinger Bands or the RSI.

- Best for: Retail traders and Forex traders.

- Tip: Be cautious of strong trends, which can break the range and invalidate the strategy.

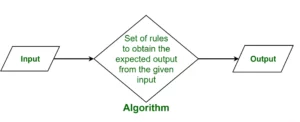

9. Algorithmic Trading

Algorithmic trading involves using automated systems to execute trades based on predefined rules. This approach eliminates emotional decision-making and ensures consistency.

- How to implement: Use trading platforms with algorithmic capabilities or develop custom algorithms.

- Best for: Financial professionals and tech-savvy traders.

- Tip: Continuously test and optimize your algorithms to adapt to market changes.

10. News-Based Trading

Markets often react sharply to economic data, earnings reports, or geopolitical events. News-based trading capitalizes on these short-term price movements.

- How to implement: Monitor an economic calendar and news feeds to stay informed about market-moving events.

- Best for: Day traders and Forex traders.

- Tip: Prepare for high volatility and set tight stop-loss orders to manage risks.

Tips for Mastering Trading Strategies

- Educate Yourself: Invest time in learning and practicing each strategy. Use simulators or demo accounts before trading with real money.

- Develop a Trading Plan: Define your goals, risk tolerance, and the strategies you’ll use to achieve them.

- Risk Management: Use stop-loss and take-profit levels to protect your capital.

- Stay Updated: Markets evolve, so continuously update your knowledge and adapt your strategies.

- Leverage Technology: Tools like trading platforms, charting software, and news aggregators can enhance your efficiency.

Conclusion

Mastering these top 10 trading strategies will give you a solid foundation to navigate the financial markets in 2025. Whether you’re trading forex, stocks, or cryptocurrencies, these approaches can help you make informed decisions and achieve consistent results.

At House of Leverage, we empower traders to unlock their potential with the resources and funding they need to succeed. Start your journey with us today and gain access to expert insights, funding programs, and cutting-edge tools designed to elevate your trading game.

Ready to trade more innovation in 2025? Visit us at House of Leverage to learn more.